Blackrock social security calculator

For security the Quick Calculator does not access your earnings record. BlackRocks iRetire joins a crowded field of retirement income calculators.

Investment Tools And Calculators For Advisors Blackrock

These tools can be accurate but require access to your official earnings record in our database.

. This is evidenced by the primary model expressed by the calculator. Ad Discover AARPs Personalized Social Security Calculator and Learn When to Apply. Earnings above this level of income are not subject to social security tax.

So benefit estimates made by the Quick Calculator are rough. Learn How Much You Will Get When You Can Get It and More With the AARPs Resource Center. The maximum Social Security benefit changes each year.

Detailed Calculator Get the most precise estimate of your retirement disability and survivors benefits. The calculations use the 2022 FICA income limit of 147000 with an annual maximum Social Security benefit of 40140 3345. 55 East 52nd Street New York NY 10055-0003 212 810-5300.

Were Asking Questions That Challenge the Status Quo and Give Rise to New Thinking. An individual born in 1968 that earns 3000 annually who last worked in 2017 would be entitled to receive 587. Ad Create Your my Social Security Account To Review Your Social Security Statement Today.

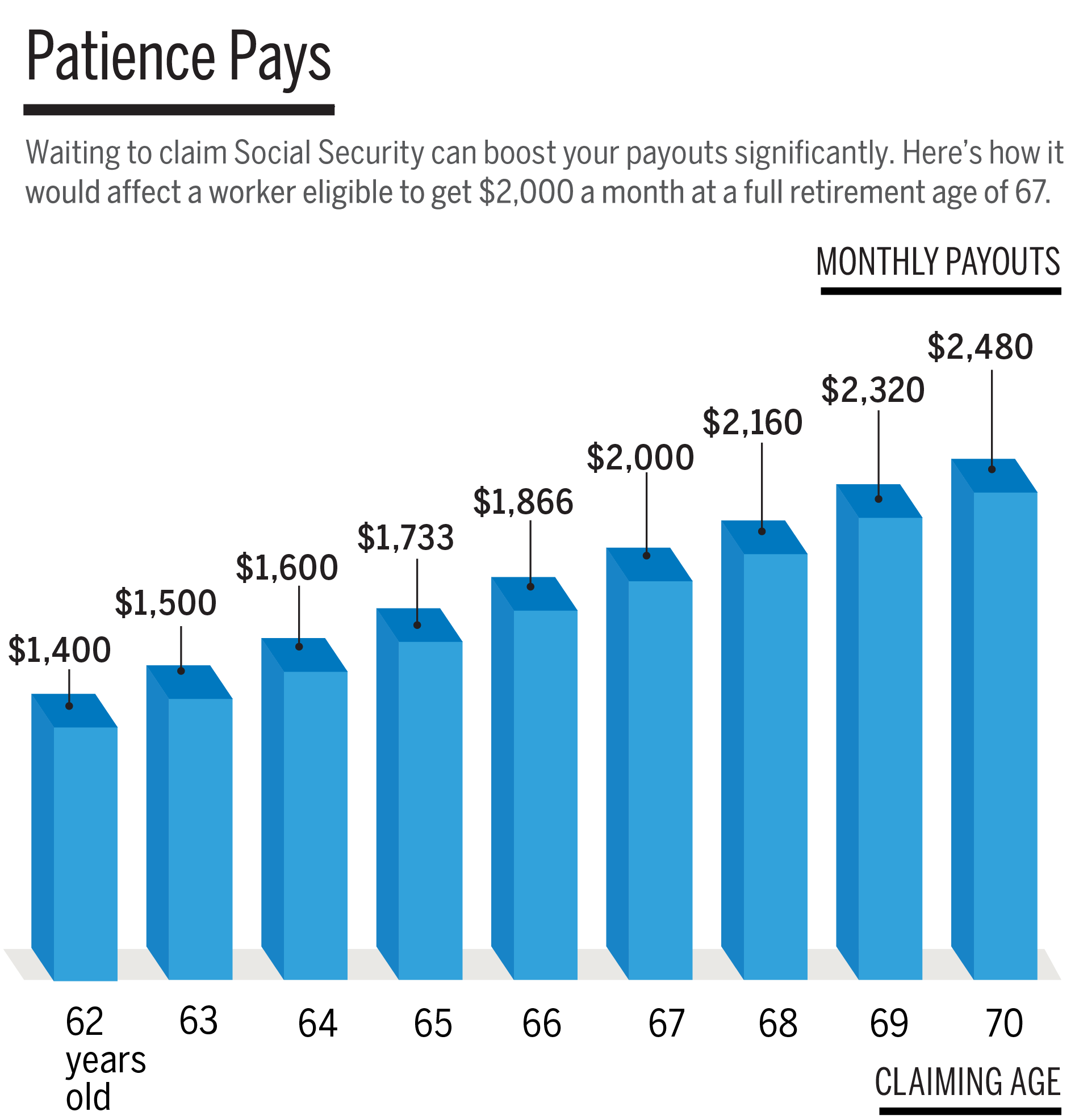

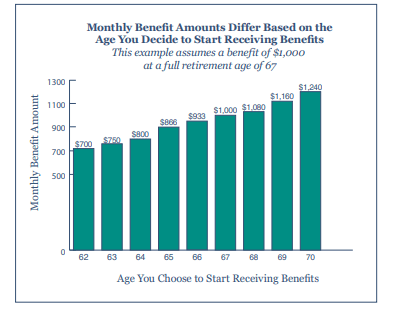

Instead it will estimate. Benefit estimates depend on your date of birth and on your earnings history. The dial above shows the percentages of the monthly benefit based on your Full Retirement Age FRA and in one year increments before and after your FRA.

This means that regardless of how much money a person earns anyone who earns at least 147000 will pay a. You are eligible to begin. These tools can be accurate but require access to your official earnings record in our database.

Quick Secure and Easy Way to Get Access to Your Information and Online Tools. Instead it will estimate. Betterment came out with a retirement calculator in April months before it launched.

The simplest way to do that is by creating or logging in to. You also get a nice bump from Cost of. Must be downloaded and installed on your.

Ad Learn How Were Helping More and More People Experience Financial Well-Being. Multiply that by 12 to get 50328 in. Estimated monthly benefit amount at three default claiming.

Name mothers maiden name Social Security number date of birth place of birth and previous years earnings. For security the Quick Calculator does not access your earnings record. Compare retirement benefit estimates based on your selected date or age to begin receiving benefits with retirement estimates for ages 62 Full Retirement Age FRA and 70.

This calculator provides only an estimate of your benefits. The estimate includes WEP reduction. For 2022 its 4194month for those who retire at age 70 up from 3895month in 2021.

To determine your PIA the Social Security Administration SSA uses your best 35 years of employment to arrive at your Average Indexed Monthly Earnings AIME. This increase is between 5 and 667 per year between age 62 and full retirement age and then 8 per year through age 70. Benefit estimates depend on your date of birth and on your earnings history.

/GettyImages-149357059-b06074af5ea4494aba83d73a3755f261.jpg)

How Do I Calculate My Social Security Breakeven Age

Financial Planning For Seniors Financial Planning Money Management How To Plan

Investment Tools And Calculators For Advisors Blackrock

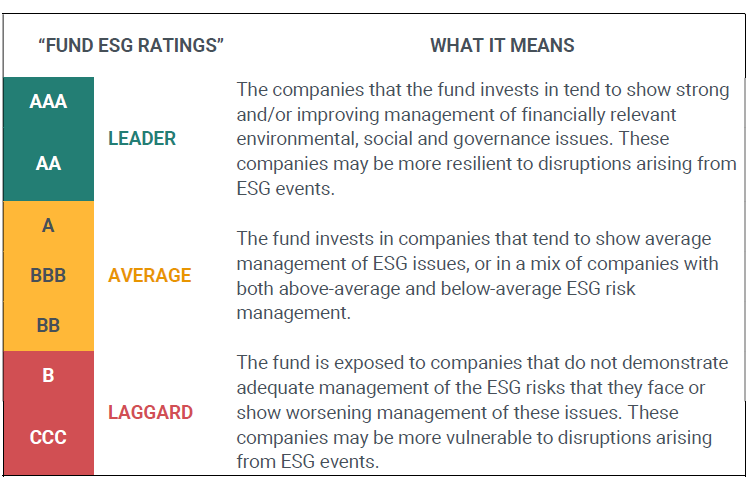

Esg Methodology Blackrock

What Is The Best Age To Start Claiming Social Security Money

Delaying Starting Social Security Via The Bridge Strategy Seeking Alpha

What Is The Best Age To Start Claiming Social Security Money

Esg Methodology Blackrock

What Is An Esg Rating

Here S How Much Social Security Benefits Are By Age And Income Level Nasdaq

Taking Social Security As An Investor Seeking Alpha

What S The Best Age To Claim Social Security 62 66 Or 70 Youtube

360 Evaluator Tools Blackrock

Optimal Claiming Of Social Security Benefits The Journal Of Retirement

Social Security Claiming Strategies How To Get The Biggest Benefit Check Thestreet

Esg Methodology Blackrock

Form 11 Mortgage Interest Deduction Understand The Background Of Form 11 Mortgage Interest D Irs Tax Forms Mortgage Interest Irs Taxes